A sustainable livelihood is indispensable for people to reach their full potential and cope with the stresses of modern life.

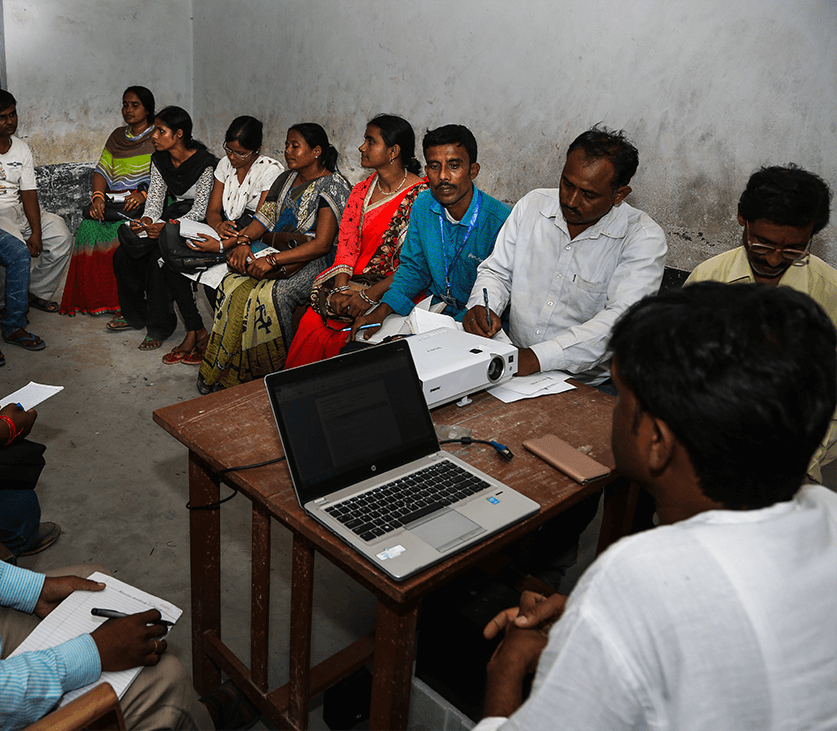

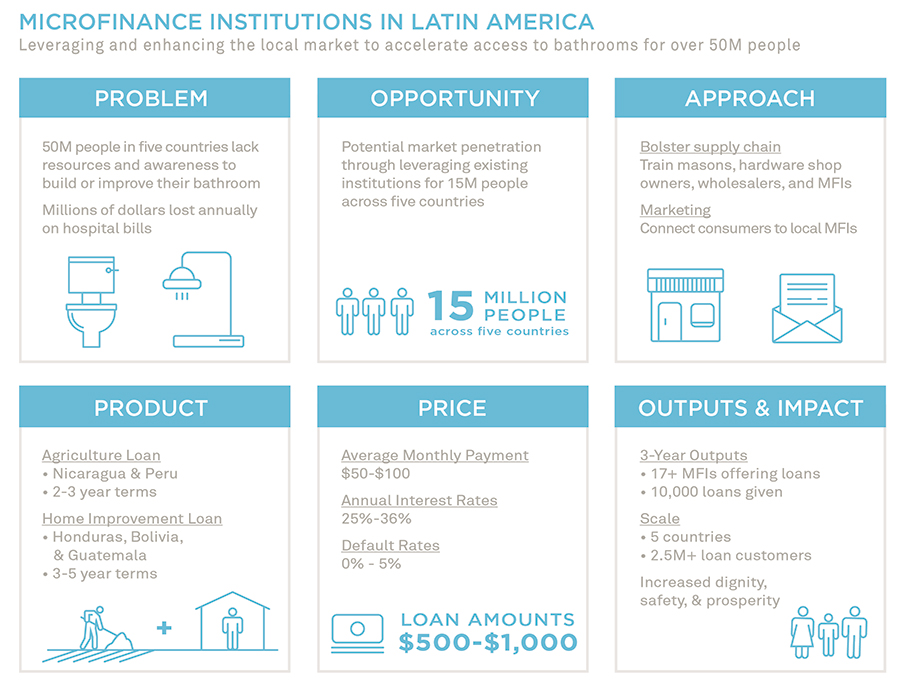

At times, sustaining a business or other means of livelihood requires financial assistance, usually in the form of credit. However, lower-income groups of India face major problems in accessing credit. Their lack of assets for collateral and limited credit history makes it extremely difficult to obtain credit from conventional financial institutions.

In these cases, microfinance programs provide a practical and valuable alternative. The easy credits provided by these programs are instrumental in reducing poverty and lifting families toward a more sustainable livelihood.